Since the pandemic, the landscape of housing options has seen a notable shift. With the cost of rent soaring an increasing number of people are seeking out alternative living situations. One of the trends emerging from high rental prices is the rise in people choosing to vehicular homelessness as a path to financial stability and independence. This unconventional choice, once negatively associated with failure, is now becoming a deliberate and necessary lifestyle choice for many to overcome financial hardship.

Best Case Scenario

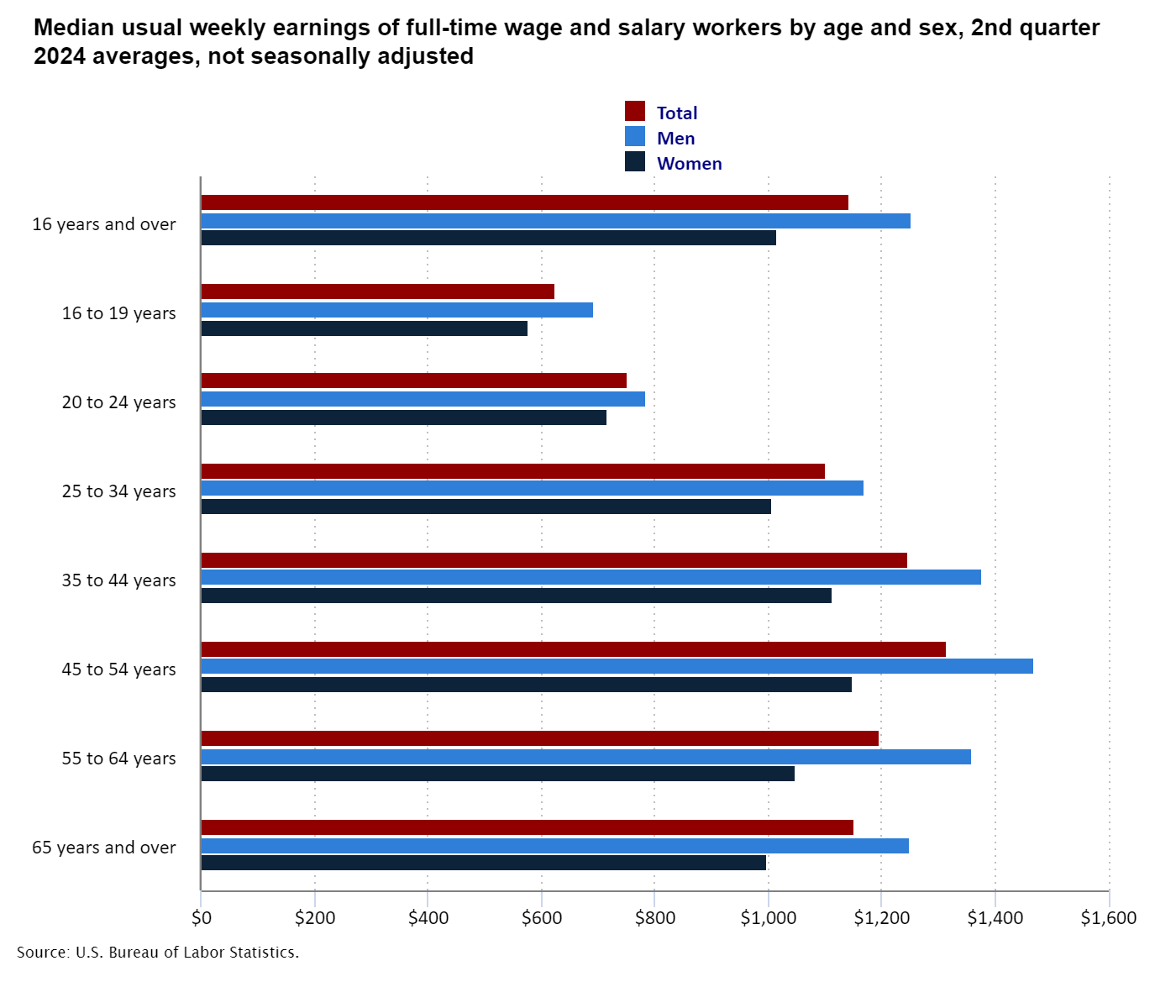

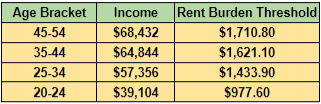

This is going to be a lot of painful information to read; however, it’s necessary to understand why finding ways to avoid paying rent is such a powerful financial maneuver in today’s world. Let’s paint an absolute best case scenario for the typical American by using median incomes for individual earners, excluding state income tax, 401k contributions, and health insurance deductions. The median income for the best performing age bracket, 45-54, is $68,432/yr or $4691.74/month after taxes. The median income for core and elder millennials, age 35-44, is approximately $64,844/yr or $4481.40/month after taxes. The median income for late zoomers and core millennials, age 25-34, is $57,356/yr or $4005.79/month after taxes. The median income for zoomers age, 20-24, is $39,104/yr or $2783.67/month after taxes. Zoomers’ incomes are expected to skew toward the left due to being in school, working part-time, and a smaller segment of the age bracket working full-time jobs. Not everyone lives in Texas, Wyoming, Florida, Tennessee, Nevada, New Hampshire, and South Dakota. Washington and Alaska don’t have state income taxes; although, they do have “insurance” taxes.

The Department of Housing and Urban Development (HUD) considers individuals to be rent burdened when rent consumes at least 30% of your gross income and severely rent burdened when rent exceeds 50% of your income.

These numbers don’t look too bad on paper and are seemingly in line with rental prices across the United States, sorry everyone living in cities with higher than average rent and real estate prices. However, let’s focus on the age groups who make up the largest share (38%) of home buyers, 25-44. Assume a run down shack is priced “conservatively” at $300,000 and interest rates are currently 6.783%, the monthly payment for the home will be roughly $2,438/month with 4% down ($12,000) on an FHA loan. Lenders also want to see at most 25-28% of gross income going to the mortgage. For the median earner, this means housing is unaffordable on a single income unless they drop a significant percentage (50-60%) as a down payment. For someone renting an apartment at $1400/month, $100-150/month for utilities, and maybe budget an extra $100/month for the extra fees and taxes associated with renting an apartment, this calculates to a loss of at minimum $19,200/year or almost half of their post-tax income. Over a 5 year time horizon, that’s almost $100,000 that could have gone toward a down payment or into an investment portfolio. Remember, this is all just a best case scenario and things are probably much worse in reality and 49.99% of the population is performing below the median.

Let’s Crunch the Numbers

You’re young, single, and want to take big strides toward financial independence. You’ve probably realized your biggest monthly expense is housing, so you’ve considered roommates, living with your parents, or living in a car as a last resort. Roommates and living with parents may not be an option for whatever reason, maybe you just don’t like dealing with people and prefer being alone and that’s completely valid—we can choose our own struggles. Now your options are to pick up a second job to soften the blow on your wallet or to move into a van down by the river. Well, working two jobs and renting an apartment doesn’t seem to make that much sense since you’ll be renting a place that is mostly used only for sleeping, so you may as well just live in a car or van and save the expense anyway, right? You could even work two jobs while living in your car to stay busy and save significantly more toward your future.

You’re a perfectly average person making $57,356-$68,844/yr and now you’re vagabond ready to seize the world. In the first year of car dwelling, you’ve paid off your student loan debt and are now debt-free. In the second year, you’ve invested $40,000 into index funds and/or into a high-yield savings account. In the third year, you’ve put $80,000 in the bag and are probably tired of living in a car—maybe look into buying a house, condo, or townhouse now. By the fourth year, you’re now holding over $120,000. In the fifth year, you have over $160,000 invested/saved or $200,000+ if you didn’t pay off debts in the first year. Had you chosen to live in apartment, you would only have saved $80,000 (or nothing at all) in the same 5 year timeframe and maybe just starting to look at becoming a homeowner whereas you would have been buying a home after your second or third year of living in a car.

It just makes sense.